Texas Mortgage Credit Certificates (“MCCs”) provide eligible first time homebuyers the opportunity to receive a federal tax credit to reduce their income tax obligation. The dollar for dollar reduction against their federal tax liability frees up income that can help the household qualify for a mortgage loan and meet mortgage payment requirements.

Type of Assistance

• Annual tax credit amount of 20% of the annual interest paid on the mortgage loan.

• The credit cannot be larger than the annual federal income tax liability, after all other credits and deductions have been taken into account.

• For a full description and explanation, visit TheTexasHomebuyerProgram.

Eligible Homes

• New and existing: Single-family homes, duplexes, townhomes, condominiums, and manufactured homes (Certain restrictions may apply).

• All properties must be located in Texas.

• Check with your participating lender for details.

Eligible Homebuyers

Homebuyers must:

• Have not owned a home within the past three years (This requirement is waived for veterans and qualifying homes in targeted areas in Texas);

• All properties must be located in Texas.

• Meet income and purchase price requirements;

• Meet the qualifying requirements of the mortgage loan;

• Use the home as principal/primary residence; and

• Complete an approved pre-purchase homebuyer education course prior to loan closing.

Length of Benefit

The Mortgage Credit Certificate will be in effect for the life of the mortgage loan, so long as the home remains the borrower’s principal residence and all program requirements are met.

Loan Requirements

• May be a conventional, 15- or 30-year fixed rate loan, such as Federal Housing Administration (“FHA”), US Department of Veterans Affairs (“VA”), US Department of Agriculture Rural Housing Services (“USDA/RHS”), or Conventional (“FHA Preferred”).

• Variable rate loans are not permitted (cannot be part of a tax-exempt bond program or a veterans’ tax-exempt bond program).

• Check with your participating lender for details.

Fees

In addition to the regular closing costs associated with the loan, there is a MCC Issuance Fee of $400.

Recapture

• MCCs are subject to certain federal recapture requirements concerning the portion of the MCC benefits granted to you upon the sale of your residence within nine years from the date of purchase.

• In no event will the recapture tax exceed the lesser of 6.25% of the highest principal balance of your mortgage or on half of your taxable gain on the sale of your residence.

• At loan closing, you will be provided additional information that will be needed to calculate the

maximum recapture tax liability at the time you sell or dispose of the residence.

How to Apply

• Contact a Participating MCC Lender at TheTexasHomebuyerProgram.

• Ask your Lender to include a TDHCA Mortgage Credit Certificate in your Loan Program and confirm if you qualify.

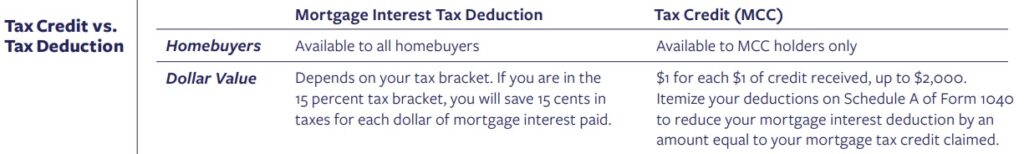

Tax Credit vs. Tax Deduction